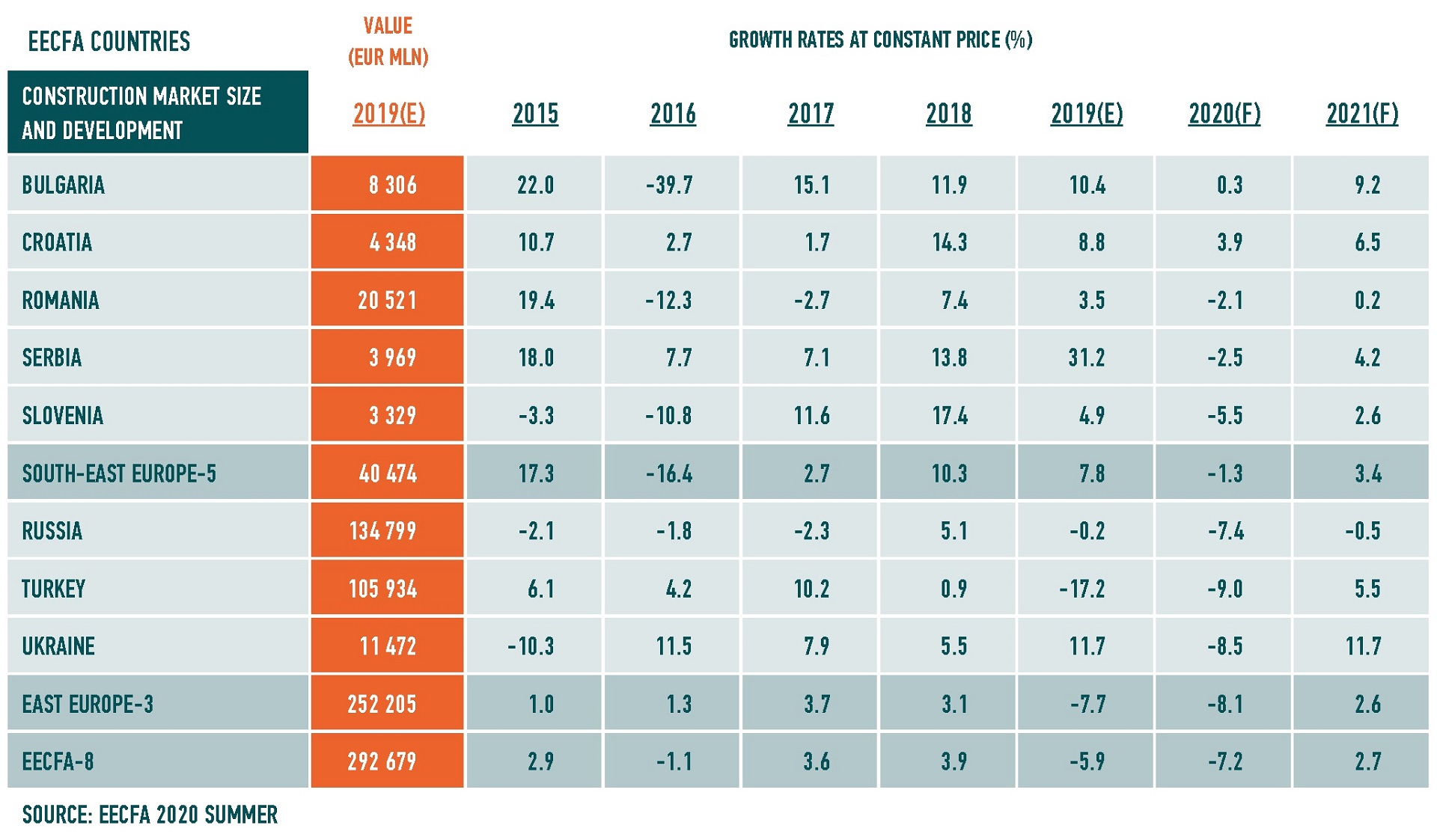

The 2020 Summer EECFA Construction Forecast Report was released on 29 June

EECFA (Eastern European Construction Forecasting Association) conducts research on the construction markets of 8 Eastern-European countries.

Southeast Europe

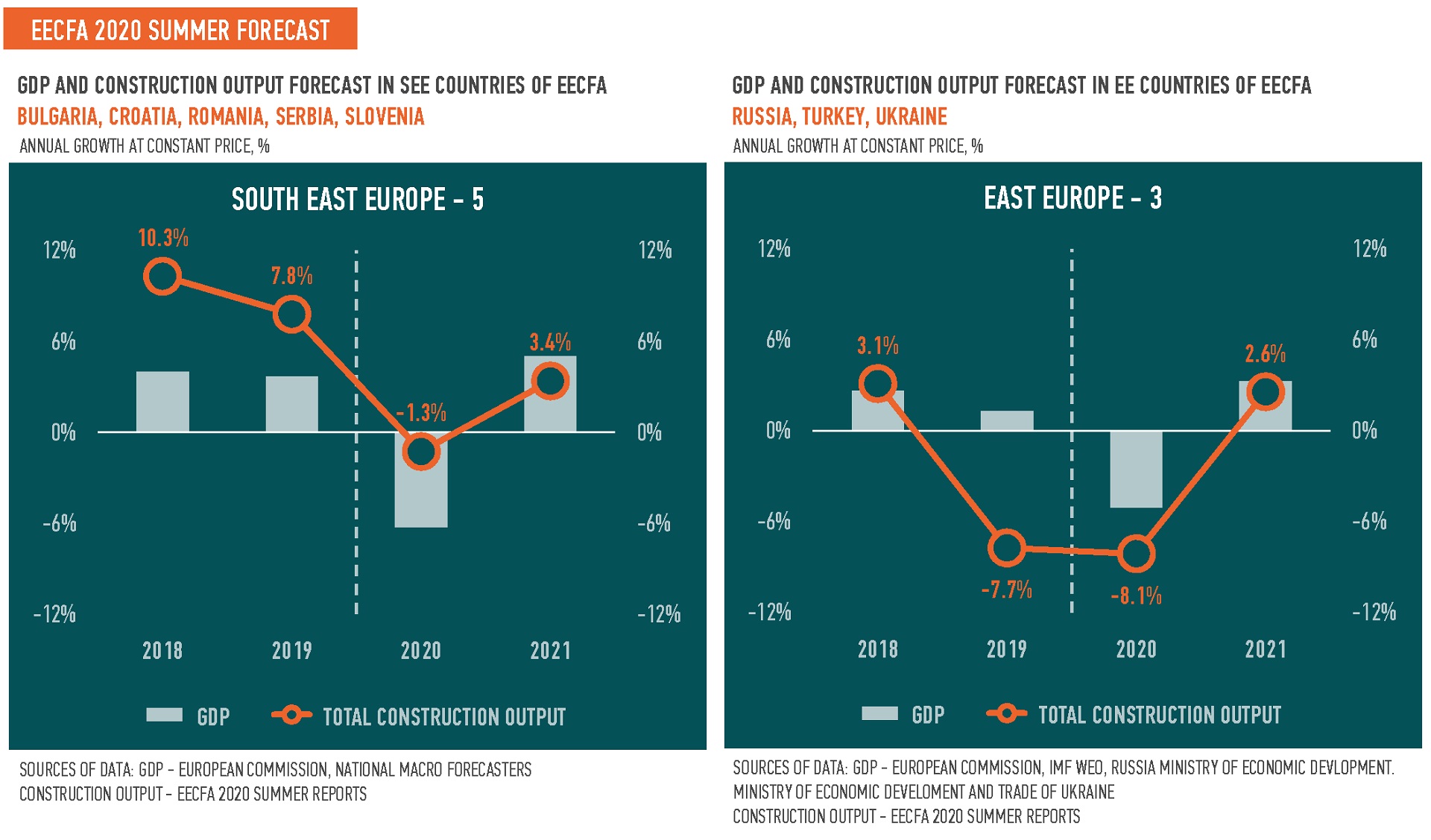

Construction in the ‘small countries’ of EECFA (Romania, Bulgaria, Croatia, Serbia, Slovenia) will be bruised by the pandemic effects this year, causing a drop in construction outputs. The two exceptions are Croatia and Bulgaria where civil engineering could compensate for the losses elsewhere. Already in 2021, we are likely to see positive growth rates in all 5 countries.

Romania. All segments of the Romanian construction market have been impacted, in one way or another, by the pandemic and the measures taken to mitigate it. Like the rest of the EU, Romania is passing through a recession, with GDP and public consumption dropping significantly in 2020. Recovery is expected for 2021, but Romania′s bounce-back might be slower than the EU-average, since there is a lack of infrastructure and public funding availability. New residential construction is predicted to perform worse than previously expected in both 2020 and 2021 due to lower demand. The non-residential subsector is also forecasted to have a rough couple of years, with companies rethinking their office needs and retail consumption trends shifting. In addition to the recession, low efficiency in EU funding absorption is also holding back civil engineering. Overall, we predict construction activity in Romania to suffer a 2.1% decline in 2020, but to recover slightly in 2021, as the economy stabilizes.

Bulgaria. Although there was no ban on construction works during the two-month state of emergency in Bulgaria, construction output growth will be hampered by the COVID-19 crisis. The economic uncertainty and rising unemployment are expected to hold back real income growth, which will mainly affect the property market. The growth driver in 2021 is set to be the completion of many large-scale office buildings, while industrial and warehousing construction is also to contribute positively. Output in civil engineering will be driven by road and public utility constructions where EU funds play a major role. The energy sector will also have a net positive impact because of the ongoing works of the Bulgarian part of ‘Turkstream’ in 2020 and 2021. Thus, total construction output in Bulgaria is to remain almost unchanged in 2020 (+0.3%) while in 2021 it is set to grow by 9.2%.

Croatia. COVID-19 and the Zagreb earthquake have dramatically weakened the short-term outlook for most building construction in Croatia. Civil engineering, though, will remain relatively unscathed. For buildings, COVID-19 has greatly affected both supply and demand for construction services, while the Zagreb earthquake has primarily influenced demand, in some subsectors in less than straightforward ways. Civil engineering as a whole remains strong despite the pandemic and the earthquake, but demand will vary considerably from subsector to subsector. Croatia’s July 5 elections will significantly influence the country’s policy responses to the problems it faces, but no matter who wins, the consequences of the two crises will affect the country’s construction sector for years to come.

Serbia. The beginning of the year was exceptionally strong for all subsectors, announcing another year of steaming outputs, but it was broken by the pandemic state of emergency and movement restrictions in April 2020. The fact that Serbia had a lockdown in the midst of an economic and construction recovery will make it one of the more resilient economies as fast recovery is expected. On the other hand, this extraordinary event will definitely affect the overall result in 2020, with still uncertain severity. After restrictions were cancelled, rebound followed on both residential and commercial markets. Home transactions had a stellar recovery in May, and the retail segment also reports pre-crisis turnovers in June. The good news is that none of the planned projects was cancelled, while several large land transactions in May 2020 announce investments will go forward. What scenario will play out still depends on the epilogue of this crisis and the eventual follow-up events during the course of this year.

Slovenia. Construction industry in 2020 and 2021 will be characterized by the short-term disruption resulting from COVID-19, and a more favourable long-term demand for construction services. The former itself, due to a 3-month long lockdown, could potentially decrease construction works by more than 10% in 2020, but anti-crisis measures, including a boost to civil-engineering construction, will be supportive. The forecasted decline in construction output in 2020 is thus 5,5%. Several big projects that started shortly before the onset of the pandemic have resumed after the lockdown such as the construction of the Second Railway Track to Port Koper and the Third Axis Road. These and a major raise in public housing (mostly in Ljubljana) should lead to a total construction output rise of 2,6% in 2021. In such a scenario, construction output will not decrease below EUR 3 billion in either 2020 or 2021, and might even act as a stabilizer for the country’s overall economic activity in contrast to the financial crisis of 2008 when a depression in construction activity represented a drag on economic development for almost a full decade.

East Europe

The ‘big countries’ of EECFA (Russia, Turkey, Ukraine) are also set to be hammered by the pandemic effects this year. Worsened by the underlying economic problems in these countries, they will likely register far bigger slumps in their construction output in 2020 than the ‘small countries’ of EECFA. But growth could return next year in Turkey and Ukraine, whereas Russia could experience a slight decline still.

Russia. The volume of construction market in 2019 is expected to have exhibited a minimal negative correction (-0.2%) due to the high base in 2018, and the decline in civil engineering caused by the completion of many big-league projects. 2020 is to see a considerable drop in construction (-7.4%) owing to a set of negative factors that the economy is battered by: falling oil prices, nosediving ruble exchange rates, as well as the subsequent COVID-19 pandemic and the long-lasting lockdown. All this has led to an economic crisis that will be felt throughout 2020-2021 and is to cause a recession in all segments of the construction market, except for strategically important ones such as infrastructure, healthcare and agriculture-related constructions. In 2021, due to the expected recovery trends in some segments of non-residential and civil engineering construction, the rate of decline will likely be noticeably slower, but the general negative dynamics will likely continue and the construction market is predicted to post a decrease by another 0.5%.

Turkey. The economy was in the process of recovering in early 2020 but had to confront with the COVID-19 problem from mid-March on, after the first positive case was diagnosed. To deal with it, the Government had to allocate big sums of money, which inevitably reduced funds to be used for projects. Precautionary measures for the pandemic and the falling exchange rate of the Turkish Lira against the Euro (by 14% between January-June 2020) caused declines in demand for many goods and services, including real estate. Incentives such as mortgage loans by state-owned banks for home buyers under market interest rates and at 90% loan-to-value ratio have become very effective: granted loans reached about 101,000 in the first four weeks of June. Building construction permits registered a historical peak in 2017, but massive drops in the next two years, which continues with a mild fall in Q1 2020. Completions, however, did not decrease in the same way as starts until Q1 2020, mainly because there are big backlogs of construction in every segment, except for wholesale and retail trade buildings. For this reason, building occupancy permits are set to continue to remain higher than construction permits during the following years. Nonetheless, we foresee further market contraction this year. Recovery could start in 2021.

Ukraine. Over the past four years, construction market of Ukraine was on a recovery path, but the pandemic and the consequent economic crisis dramatically worsened construction trends and expectations in the country. Current indicators of the volume of capital investments and a drop in construction volumes suggest a slump in the construction market. Under such conditions, state support and bank lending would remain a reliable means for the construction market, but developers stopped borrowing during the lockdown, and bankers predict a great decrease in business lending. Future construction trends will largely depend on the dynamics of the economic recovery. The government’s economic recovery program contains no targeted measures to support the construction industry or mortgage lending, leaving builders alone in the fight against the crisis. Residential market is expected to shrink most in 2020 and each sub-sector is foreseen to come back in 2021.

If you would like to receive a sample report please use the following contact button or send an e-mail to sales@proidea.ro.