EECFA (Eastern European Construction Forecasting Association) conducts research on the construction markets of 8 Eastern-European countries. The 2020 Winter EECFA Construction Forecast Report was released on 8 December.

Southeast Europe

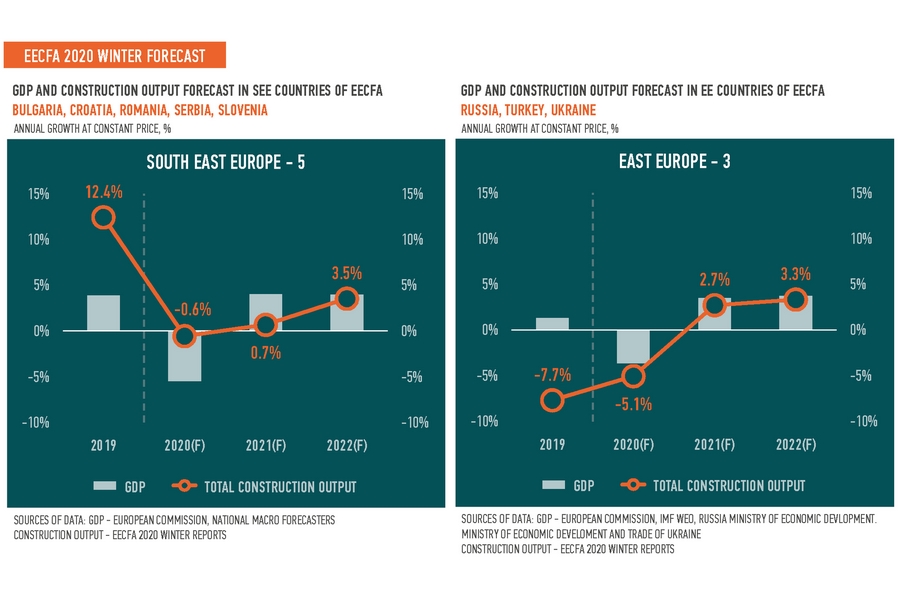

Building construction markets of the Balkan EECFA countries as a whole have shown resistance during the pandemic so far. Nonetheless the region is foreseen to have yet another negative year in 2021, before expansion can return in 2022. As the current EU programming period is nearing its end, civil engineering is expected to be the driving force in the upcoming period, well outperforming building construction.

The total construction market is projected to side move in 2021, and 2022 could bring a growth of around 4%. Based on its priorities, the NextGenerationEU recovery fund is also supportive for both building construction and the civil engineering sub-markets. Its specifics (for what and when) on country level are yet unknown, though.

Bulgaria

The expected economic recovery should bring the Bulgarian economy back to pre-crisis levels by end 2022 with both exports and consumption contributing positively. Having it in mind, the future of residential construction remains positive despite the economic uncertainty. In short term, purchasing power should be affected, but in general, demand for new housing projects in big cities should remain.

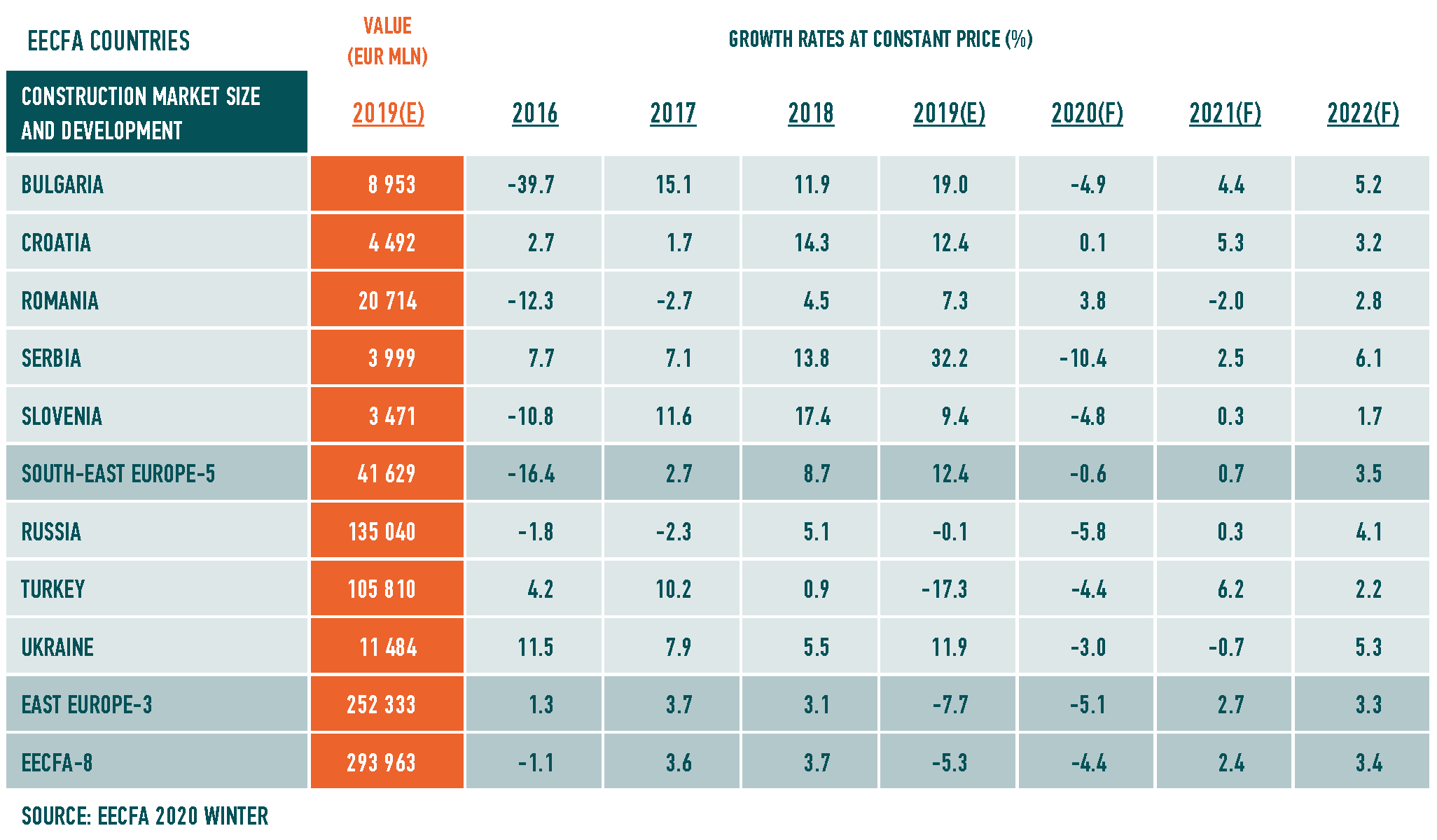

Non-residential construction will also be held back by dropping demand for commercial and hotel projects, and the projected slow and uneven economic recovery. Civil engineering in the future should be driven by EU funding as well as by the national budget. After major growth in total construction output in 2019 (+19%), 2020 will likely see a drop of 4.9%. Approaching the end of the programming period in 2021 and 2022, total construction will likely increase by 4.4% and 5.2%, respectably, in real terms.

Croatia

The effects of COVID-19 and the Zagreb earthquake on the Croatian construction industry will vary greatly from sector to sector. Thanks to swift, massive EU financial assistance, some sectors will even benefit from the disasters. These sectors include civil engineering generally and especially those CE sectors in which projects can be implemented rapidly. For buildings sectors, results are mixed. Some were harshly battered and will take years to recover. Others barely felt the catastrophes’ consequences. With few exceptions, the trends that underlay buildings sectors’ growth before these events will remain the primary drivers of buildings output in the medium and long run. In the short term, disaster-relief spending will benefit some.

Romania

Pandemic impact on construction was felt less strongly in 2020 since ongoing projects were not halted and thus the market slightly grew (3.8%). With the entire economy taking a few years to recover after the 2020 crisis, total construction output in Romania should drop in 2021 (-2%) and start recovering in 2022 (+2.8%). The pandemic will water down the housing subsector next year as fewer-than-expected new projects began this year and the recession should also continue to reduce purchasing power. In non-residential, retail and hotel were battered most.

Office construction is in hiatus due to lower demand for new construction with the expansion of work-at-home scheme and with businesses rethinking the use of traditional offices. The drop in international trade set back industrial construction, but as borders open and exports start picking up, recovery may come too. Civil engineering is the brightest spot with an estimated growth in government investment as 60% of the EU funding for infrastructure is still unspent from the 2014-2020 budget.

Serbia

The developments in 2020 are marked by the reoccurring pandemic and during the year, movement restrictions were introduced twice, having a very negative effect on all service sectors. Furthermore, it is now certain that pandemic effects are to extend into 2021 and the best-case scenario means the economy will take the entire 2021 to recover. With still large uncertainty looming for next year, the forecast still carries a lot “ifs” and the government spent over 10% of GDP for various stimulus measures aiming to mitigate the effects of the interruptions. While the recovery in the second half of 2020 was strong, the new restrictions in October and December again impacted developments and stopped the normalization. Luckily, the realization of big public infrastructure projects has been steady and growing, which has helped growth in construction outputs, and private investments are still not subsiding. Strong credit activity and market fundamentals are also supporting recovery, but lingering foreign demand and slow recovery in the service sectors continue to dim the prospects.

Slovenia

Construction industry was less disrupted by COVID-19 that some were fearing. Even though construction output is estimated to have dropped by 4.8% this year, it will likely rebound next year close to the 2019 level and should expand further in 2022 on the back of civil engineering where big projects are continuing apace. The Second Railway Track to Port Koper, the Third Axis Road construction and the Karavanke Tunnel expansion all continued in 2020 and were less disrupted by the lockdown than expected. Non-residential construction, on the other hand, will suffer from the lingering effects of the economic slowdown caused by the pandemic and the consequent lower investment in industrial and commercial segments. Similarly, residential construction is subdued for the time being due to the pandemic but may return to growth path towards the end of the forecast horizon based on historically low interest rates and good availability of credit financing.

East Europe

Dragged down by Turkey, the decline in buildings construction started in the Eastern region of EECFA as a whole well before the pandemic struck. And 2020 is also expected to see a negative year. From 2021 on recovery could start, but the level of 2018 is not projected to be reached on the forecast horizon. The civil engineering submarket of the region also contracted massively already in 2019 and further decline is our scenario for this year. From 2021 on this submarket could turn to positive and we are optimistic for 2022 as well. Total construction market of the Eastern region is forecast to grow by around 3% in each of the upcoming 2 years.

Russia

This year has seen several negative factors blasting construction industry in Russia, and the economy, such as falling oil prices, the devaluation of the rouble at the beginning of the year, and the pandemic with its related lockdown and restrictions. This caused a massive decline in real incomes, a deterioration in investment climate and a downturn in business activity. One way or the other almost all construction segments felt the pain and decline in total construction by end 2020 is to be 5.8%. It is better than our summer 2020 predictions, though; the government’s economic recovery plan turned out to be quite effective and allowed us to slightly improve our forecast. Return to growth in construction is possible already in 2021 (+0.3%), and by end 2022 a much more confident positive dynamics (+4.1%) is expected based on the likely recovery trends in all segments on the back of state support and the launch of big infrastructure projects.

Turkey

The economy was marred during the 3 months after COVID-19 appeared on 11 March in Turkey. Anti-COVID measures put in place caused massive declines in industrial production, including construction, and in GDP. Lifting most measures and introducing a subsidy offering soft loans by the three state-owned banks on 1 June 2020 served as an important stimulus for the economy and the construction sector. Together with a historical peak in housing transactions in July 2020, building starts began to grow, although there is a big backlog of construction in almost every sector. Rising inflation and construction costs owing to the depreciation of the Turkish Lira against foreign currencies would be the primary concern for the construction sector in 2021.

Ukraine

Construction this year showed a negative trend compared to last year. After a relative growth in Q1 2020, there was a significant dip in Q2, followed by a gradual recovery in Q3-Q4. Nominally, at end Q3 construction reached last year's indicators in the volume of works performed, but with inflation considered, the drop is still 2%. In the same period last year, construction showed a rise of 23.5%. Key negative factors this year are the COVID-19 crisis and the reform of the State Architectural and Construction Inspectorate that started almost simultaneously with the lockdown in early spring. As a result of falling population incomes and complications in obtaining construction permit, the volume of housing construction slumped. Civil engineering fared well thanks to a state program and the redirection of part of the money from the Covid Fund into the subsector.

Source of data: EECFA Construction Forecast Report, 2020 Winter.

If you would like to receive a sample report please use the following contact button or send an e-mail to sales@proidea.ro