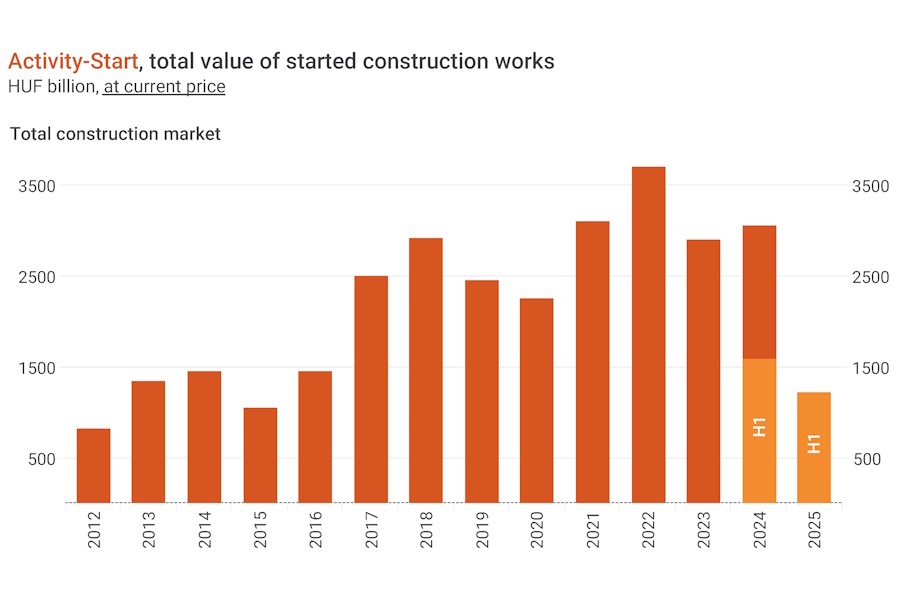

Q2 2025 sees the value of started construction projects in Hungary drop compared to Q1

On a quarterly level, the value of started construction projects in the second quarter of this year has been the second lowest since 2020 and Activity-Start at current price did not reach HUF 470 billion. In the first half of the year, projects entering construction phase were worth around HUF 1,200 billion, far below the previous years and close to H1 2020 when the pandemic hit. The situation is even worse at constant price, and when adjusted for price changes, Q2 2025 has been the second worst quarterly Activity-Start since 2015.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Eltinga, Buildecon (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

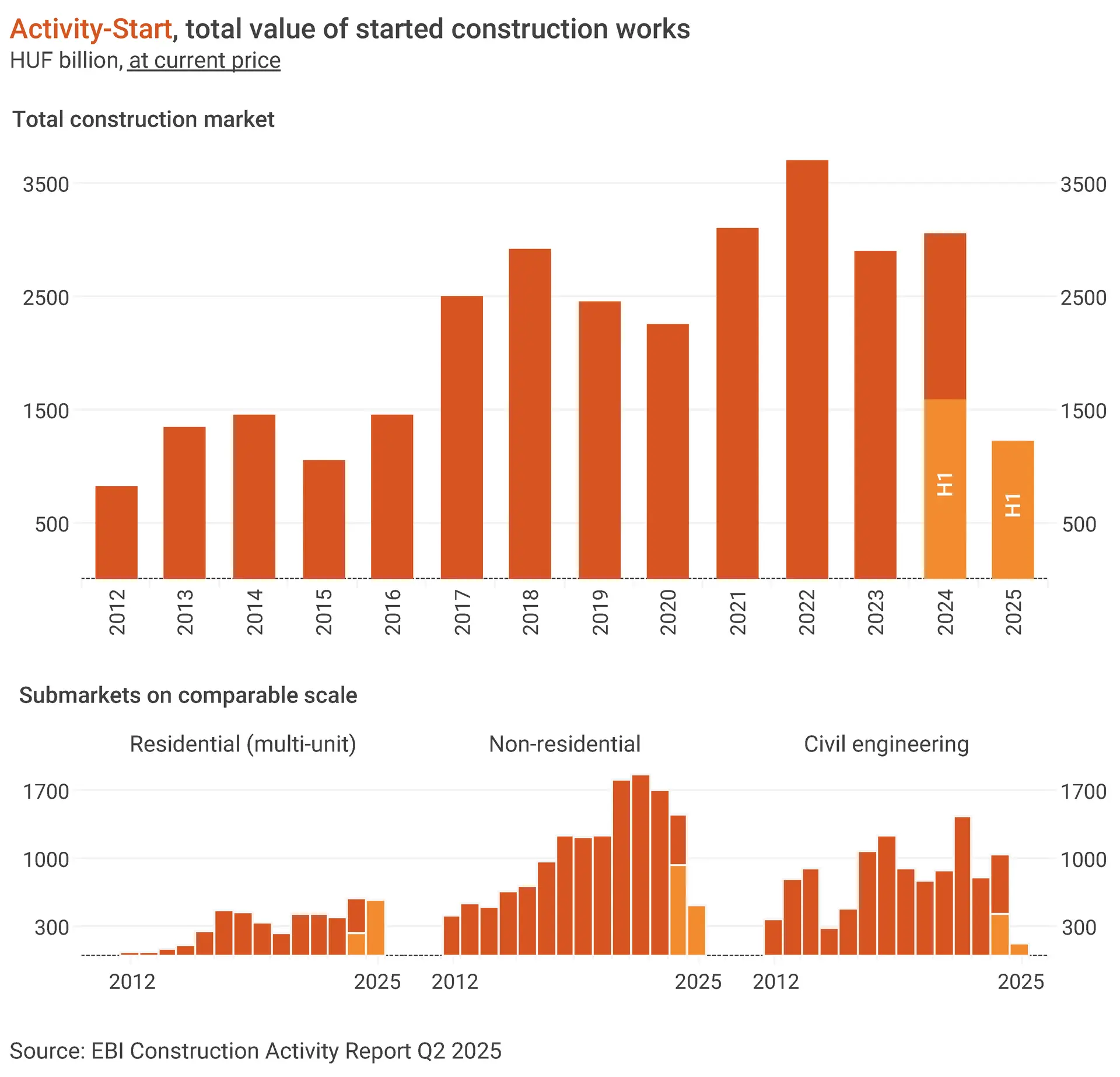

Building construction performed poorly in Q2 2025

In Q2 2025 the value of building construction starts fell below HUF 400 billion, barely reaching half of the Activity-Start of Q1. After 2020 it was only in Q3 2024 when the value of construction starts was at a similarly low level. The decline in building construction was even more pronounced at constant price: Activity-Start of EBI Construction Activity Report at constant price was last lower in Q1 2015 than in Q2 this year.

Such a poor performance in building construction occurred despite the extremely successful quarter in multi-unit housing construction. The Activity-Start for non-residential construction fell to a critically low level not seen since Q1 2015, below HUF 120 billion. At constant price, the decline is even more drastic, the value in Q2 2025 was less than half of the previous negative record.

The largest building construction projects during Q2 2025 were mostly multi-unit housing ones. Only one non-residential project made it to the list of the biggest projects, Phase 1 of Halms automotive parts manufacturing plant in Miskolc.

Better Civil Engineering Activity-Start, but still at a low level

Q2 2025 saw an improvement over Q1 in Civil Engineering Activity-Start of EBI Construction Activity Report, but projects started only at a value of around HUF 100 billion. In the road and railway construction segment, there was an increase in Q2 2025 against Q1 with projects entering construction phase on HUF 50 billion, a level not considered high.

The biggest civil engineering projects launched in Q2 2025 include the railway infrastructure of the Ivancsa industrial-innovation development area, the XIV/A water shaft in Tatabánya, and the development of the drinking water networks in Ács, Bábolna and Koppánymonostor.

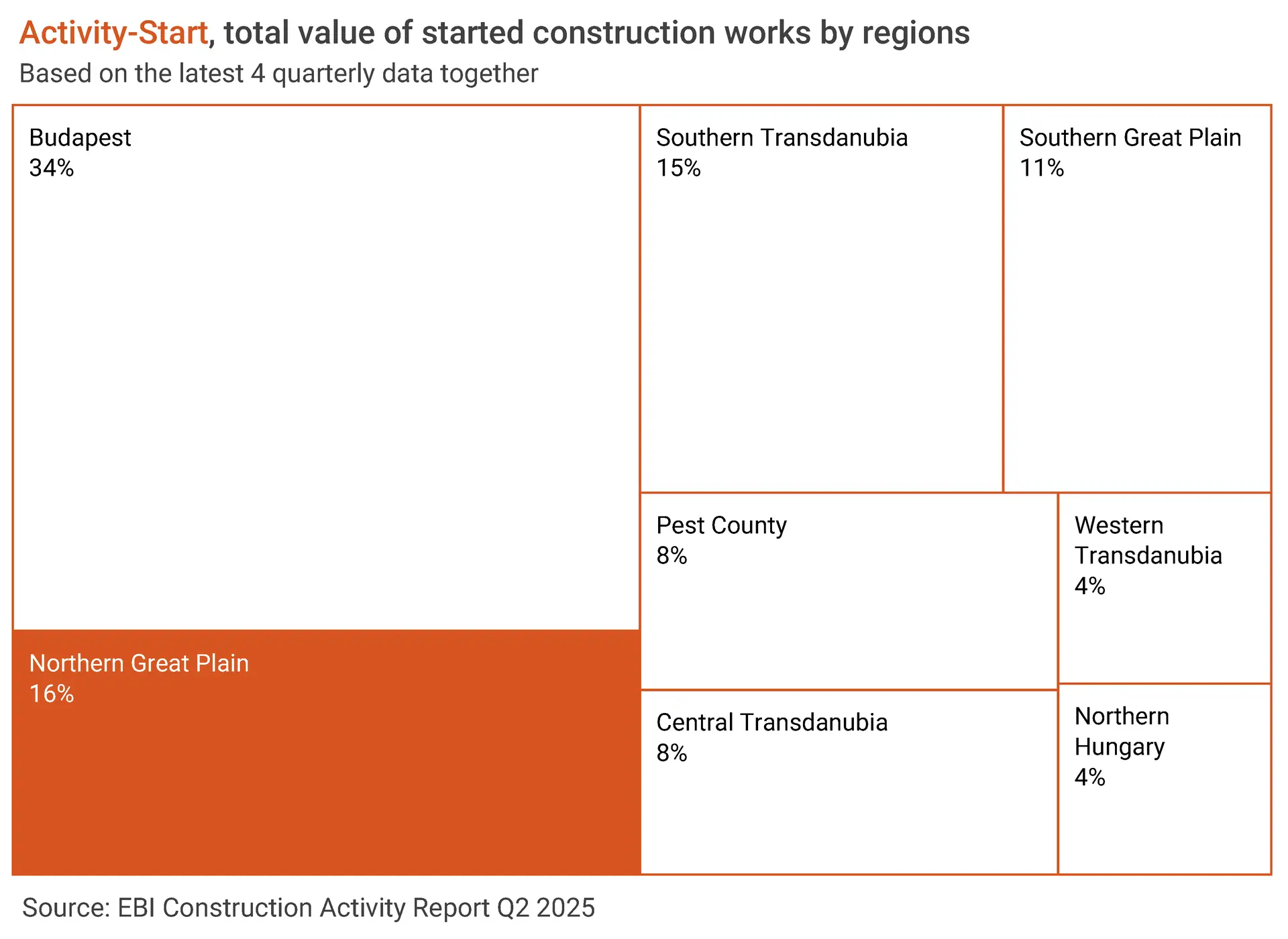

The capital city has the highest share in total Activity-Start

Looking at construction projects launched in the past four quarters, Budapest had the highest value with a share of 34% in total Activity-Start. It still exceeds the 20%-30% typical of the period between 2021 and 2023.

In the previously leading Northern Great Plain, 16% of projects started. The share of Southern Transdanubia was 15%, and that of the Southern Great Plain was 11%. The lowest values were registered in Northern Hungary and Western Transdanubia during the period, with a share of 4% each. In Central Transdanubia and the Pest region, a respective 8% of projects were launched.

Favourable trend continuing in multi-unit housing construction

Q2 2025 far exceeded the average of recent years in terms of the value of construction starts: multi-unit housing constructions started at HUF 250 billion at current price. This is an absolute record, the second highest value after Q1 2025 registered since 2014. Activity-Start of EBI Construction Activity Report in the segment exceeded HUF 200 billion for the third consecutive quarter, way more than the previous highest HUF 144 billion until H1 2024. The expansion was also significant compared to previous years, even when calculated at constant price.

The momentum fuelled so far by maturing government bonds and interest payments may continue this autumn with the launch of the Home Start Program (providing first-time home buyers with a fixed-rate loan of up to HUF 50 million at a 3% interest rate). Also, this autumn, projects financed by the Housing Capital Program this year (a government initiative to help the supply side) may also appear among sold homes. As a result of these, a pick-up in both demand and supply is expected for the rest of the year. In Budapest, the projects of the Housing Capital Program may be the source of a further high level of Activity-Start. In the countryside, more multi-unit housing projects may start due to the livelier demand thanks to the launch of the Home Start Program. In the capital city, the number of available new homes is already at one of the highest levels in recent years because of the previous significant construction starts. This, in addition to the new supply, may make developers more cautious with project launches as the end of the year approaches.

The value of completed multi-unit homes in Q2 2025 was around HUF 90 billion, a slight increase compared to Q1. Overall, Activity-Completion of multi-unit housing constructions slightly dropped in the first half of the year compared to the previous year, remaining roughly at the 2023 level.

Looking at the past four quarters, Budapest has had a massive share in multi-unit housing constructions entering construction phase (75%), while none of the other regions reached 10%. In Central Hungary 77% of such projects started and in Western Hungary 14%, while only 9% of the Activity-Start was registered in Eastern Hungary.

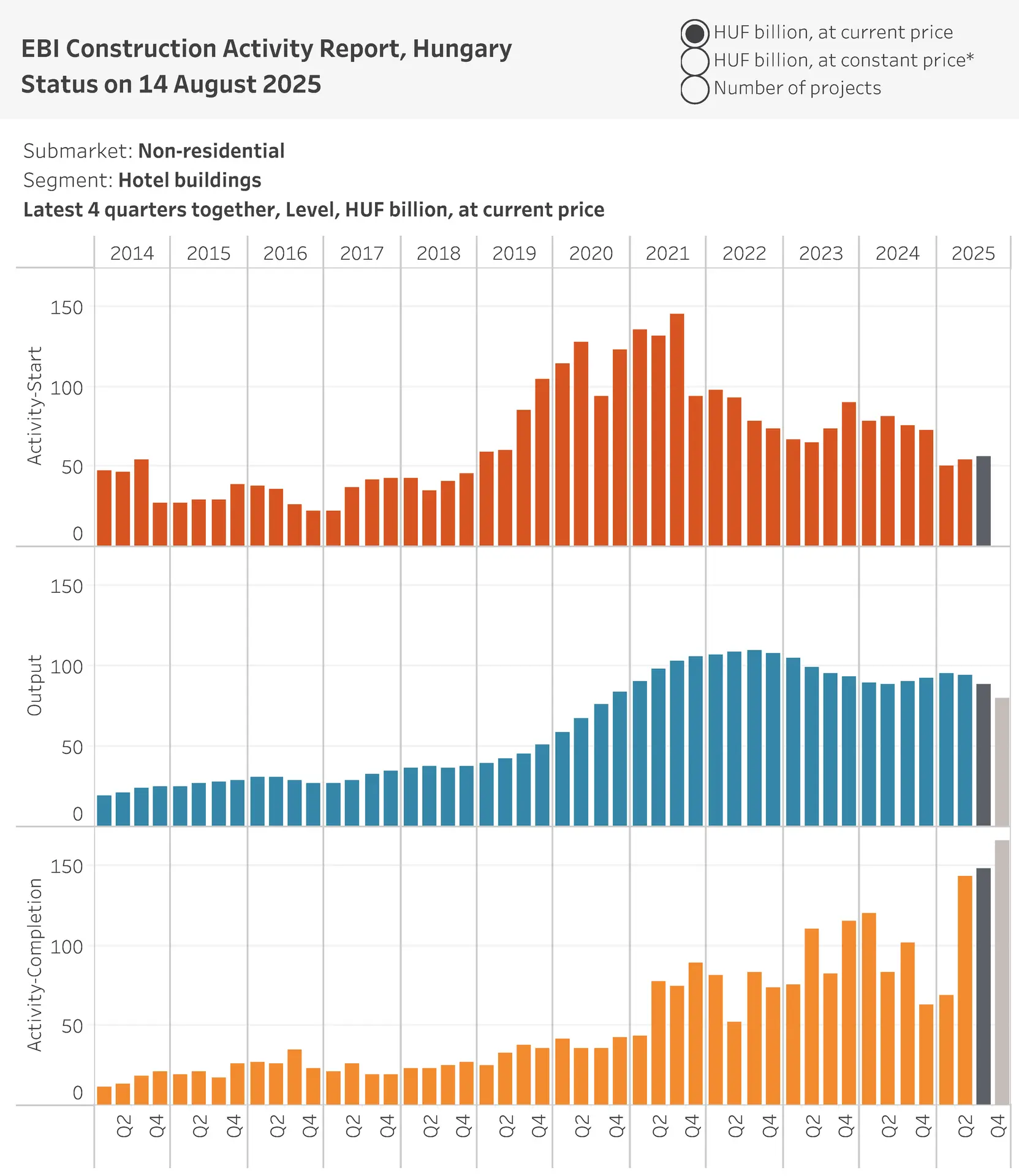

The year started off sluggishly for hotel projects, but growth is visible

Hotel construction works boomed in 2019-2020 most, but projects also commenced in 2021 and 2023 at relatively high values. 2024 saw a slight decline, and this year also started rather sluggishly. The second quarter brought some expansion, though; between April and June 2025, the total value of construction starts in the segment was over HUF 20 billion, a major improvement compared to the previous, very weak quarter, and roughly the same as the median for the period between 2023 and 2025. At constant price, we also see that Activity-Start of EBI Construction Activity Report in Q2 2025 does not differ much from previous quarters but is far behind the high values between the end of 2019 and the beginning of 2021.

The largest started hotel projects in H1 2025 included Phase 1 of Staybridge Suites Hotel in Budapest and the MCC Talent Development Center project in Miskolc.

Several hotel projects that were launched in previous years have now reached completion. In Q2 2025, Activity-Completion in the segment set a record, approaching HUF 90 billion at current price and exceeding HUF 160 billion at constant price. Also, many hotel projects are currently underway which are due for delivery next year, such as the renovation of the Grandhotel Galya in the countryside, and a number of hotels under construction or under renovation in Budapest: Sofitel Budapest Chain Bridge, hotel in Kígyó street, VP36 Boutique Hotel, Paulay Opera Hotel, Hotel Paulay (Puro), Moxy Budapest Downtown by Marriott, and Hilton Garden Inn. Hotel Gellért in the capital city is also undergoing renovation and may be completed in 2027. Klotild Palace St. Regis Hotel and K36 Hotel and Student Hostel are also nearing completion and could open this year.

Original article: Tünde Tancsics (ELTINGA); English version: Eszter Falucskai (Buildecon)