Written by Dr. Sebastian Sipos-Gug - Ebuild srl, EECFA Romania

This question is quite often asked both by those looking to buy a home and by those building homes. The former are hoping for prices to come down, while the latter are worried that prices will come down. Whereas a definitive answer cannot be given, Dr. Sebastian Sipos-Gug, EECFA’s researcher on Romania, has looked at several factors that might tip the balance of the residential market, one way or the other.

For a more in-depth analysis and forecast you can purchase the latest EECFA Romania Construction Forecast Report at www.eecfa.com. EECFA (Eastern European Construction Forecasting Association) conducts research on the construction markets of 8 Eastern-European countries, including Romania.

Where we are now

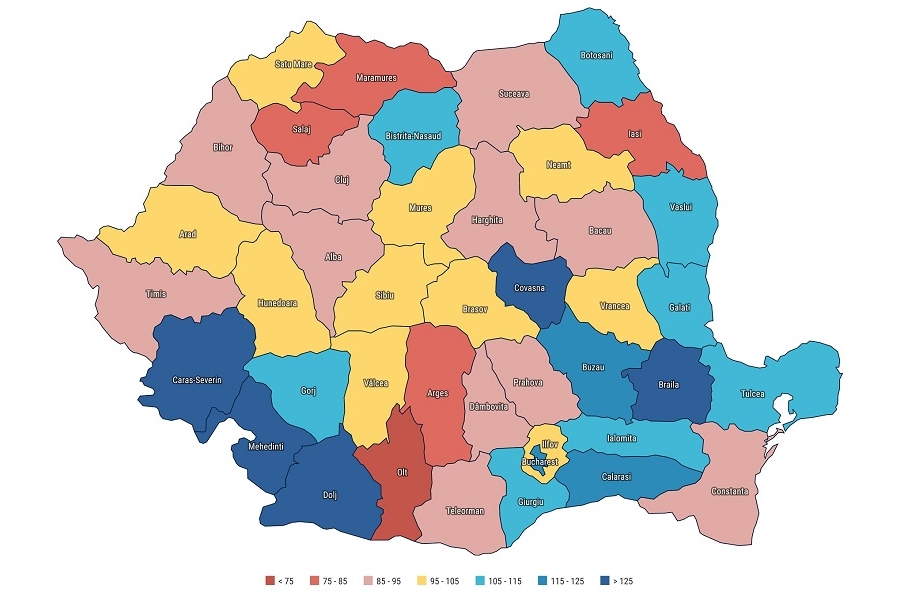

Despite a rocky start, real estate sales in 2022 were comparable to those of 2021 (+0.2%, source: ANCPI) and so, at least from this point of view, the market seems to be relatively stable, and could tip either way. In a regional view, the northern half of the country was more likely to see a drop in transactions, and Bucharest remains the most active market, with 1 in 5 real estate sales registered in Romania in 2022 taking place in the capital city.

Looking at the longer-term trends, the number of sales in 2022 were 29% higher than those of 2019, but still below the peaks of 2015 (-21%) and 2008 (-31%), and thus it would seem like we are approaching another turning point in the market cycle.

From a house price perspective, there are some signals that asking prices started to go down, however, as of Q3 2022, this didn’t translate in a decrease in official transaction prices. Instead, prices kept rising, albeit their growth rate has somewhat slowed down.

Residential real estate as an investment vehicle

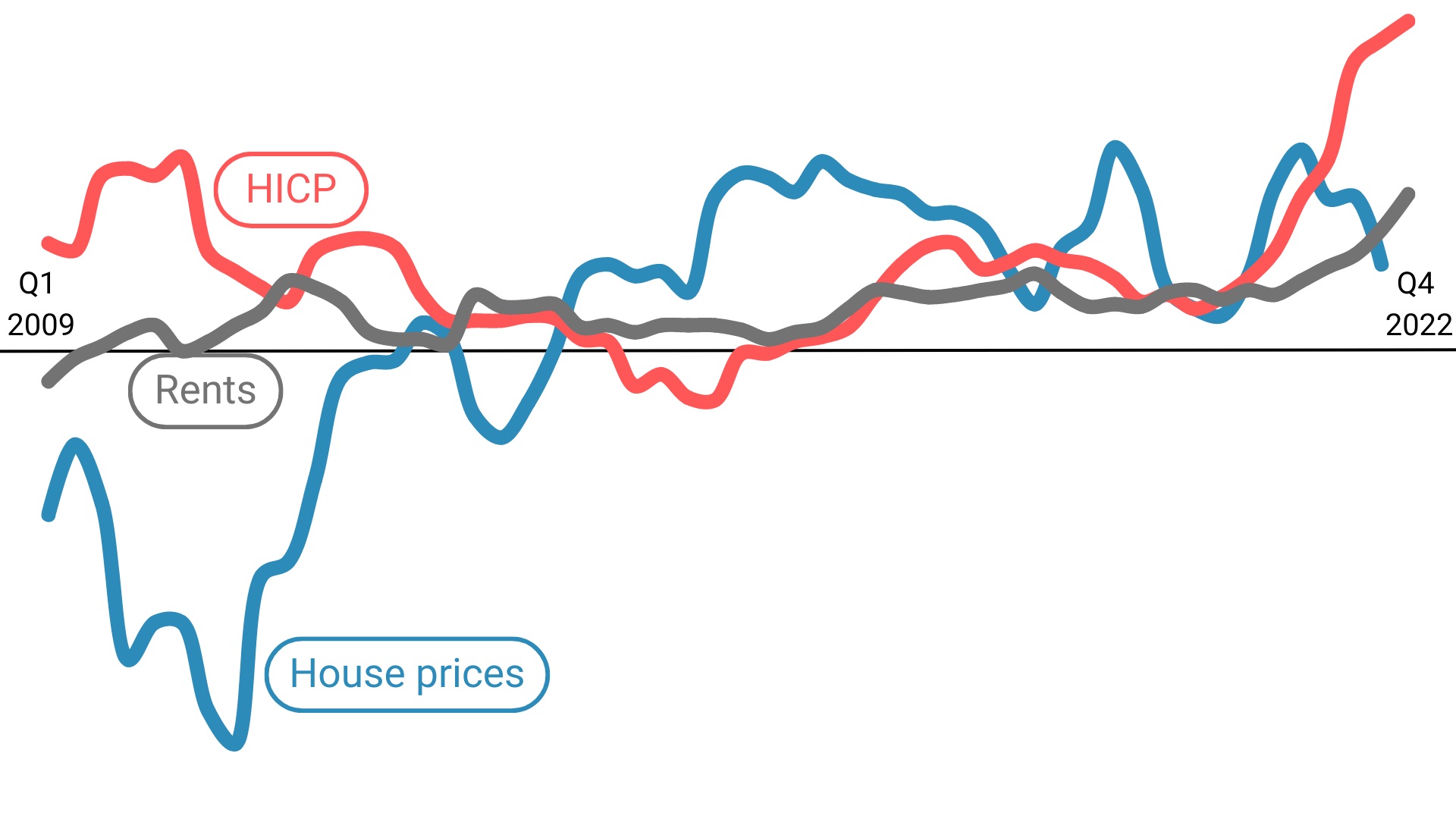

While no official data is available, anecdotally a significant share of newly built homes have been purchased as an investment asset, rather than to be lived in by the owner. Between 2015 and 2019 the increase in prices outperformed inflation and rent growth. Coupled with a low reference interest rate, which made loans cheap and made savings offer lower returns than inflation rate, many retail investors turned to real-estate, with residential being the most accessible market.

As inflation soared in 2022 (+13.8% yearly average), residential prices failed to follow. With inflation expected to remain high in 2023 and 2024 (+10.8% and +5.7%, according to the CNP forecasts, or +9.7% and +5.5% according to the EC forecast), the appeal of investing in residential properties would diminish, pushing down demand, transactions and prices and thus potentially leading to a negative feedback loop. Since real-estate has traditionally been held as an inflation hedge, prices would have to drop quite significantly to trigger this type of loop, a scenario that many feel unlikely at the moment.

Home affordability

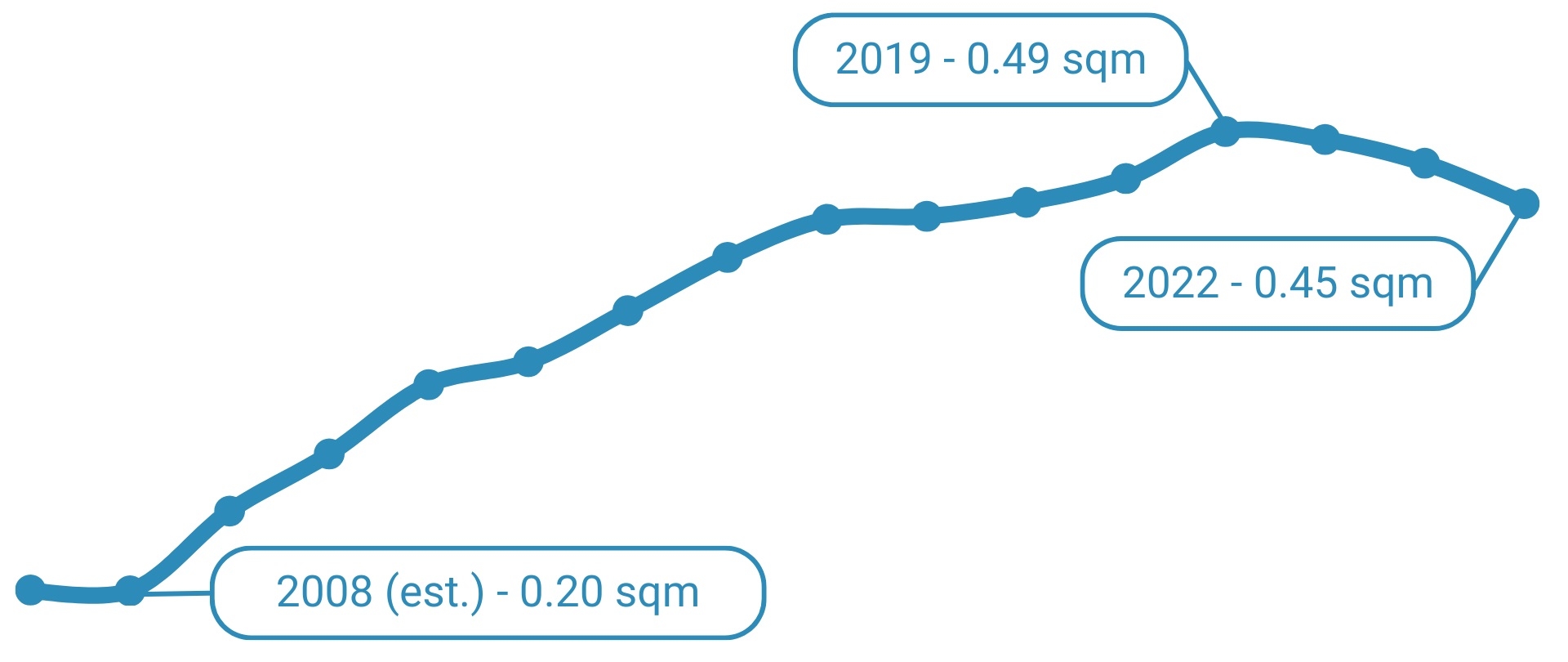

Most home purchasers are looking for a place to live, and for them affordability is a very important factor. A useful estimation is that of comparing average prices to the average income, an indicator we looked at in previous blog posts (here, and here) as well. While in 2007 the average monthly wage could buy you 0.20sqm in an average sized two-room flat, this steadily grew to around 0.50sqm in 2020. However, it declined to 0.45sqm in 2022, making homes slightly less affordable for the average worker.

To add to this, rising interest rates for mortgage loans make it even harder to buy a home. In 2022 there were 8 hikes to the National Bank’s reference interest rate, that climbed to 6.75% in December, up from 2% in January 2022. This translated into a near doubling (+82%) of interest rates for new housing loans, and they will remain high as long as the National Bank keeps reference rates up. As inflation subsides, cheaper loans might be on the horizon with a positive impact on demand for residential real-estate for both housing and investment purposes.

Construction costs and energy prices

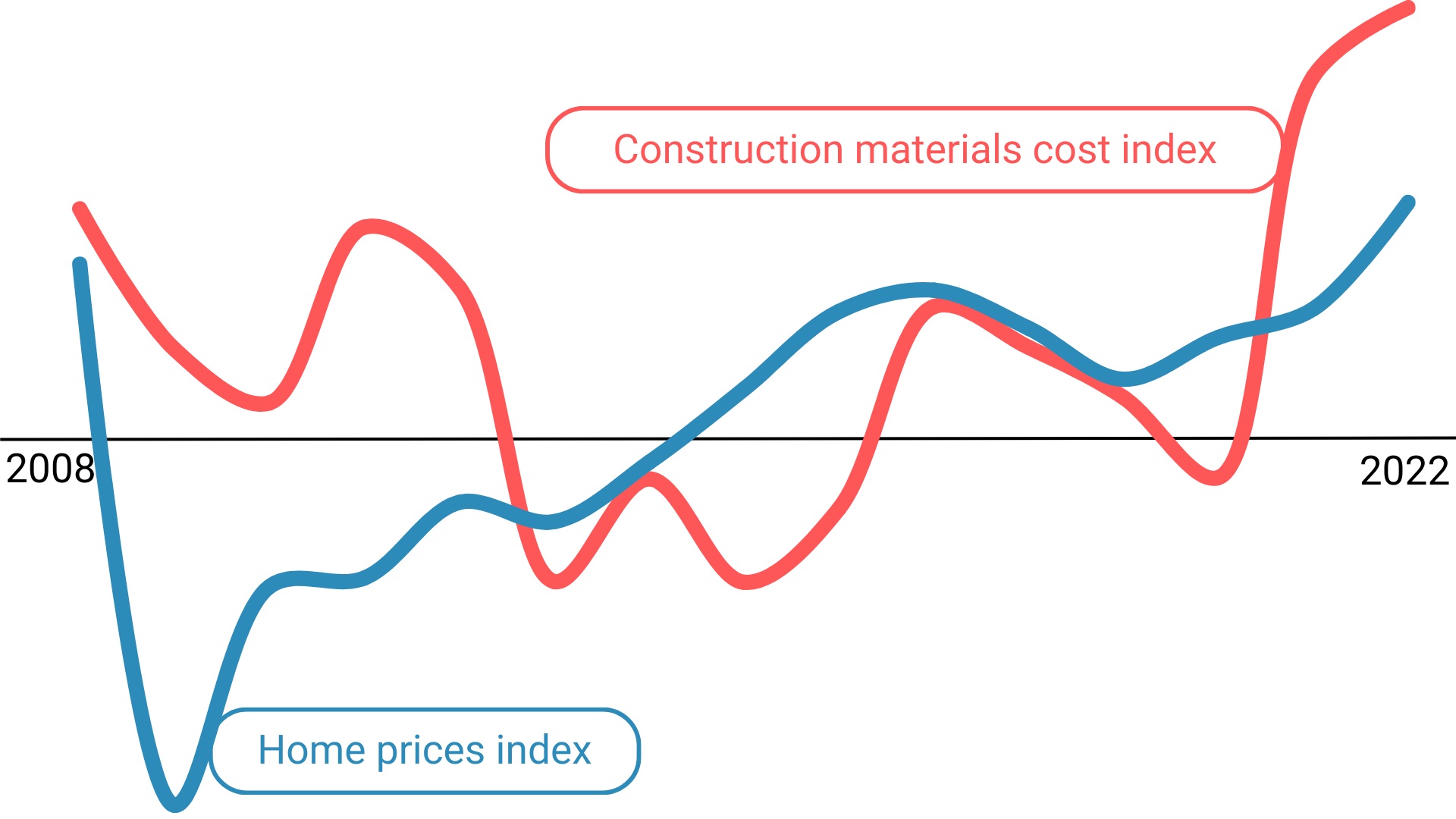

We touched on construction cost increases last year in a blogpost and looked at the factors behind it in yet another post (in Romanian). The situation has not significantly improved since. In 2022 materials costs continued to increase more than prices, putting a dent in developers’ ability to self-finance their projects. With global logistics and energy markets upended by the pandemic and the war in Ukraine, a decline in construction costs remains unlikely. So, developers are pushed into either eating some of the increased expenses or passing them along in the form of increased prices. Due to the previously mentioned factors, price rises might not be well received by the market, and so profit margins would be pressured downwards, leading to a decline in further investment, in the short run.

Supply side

The demand-side indicators reviewed previously are only half of the equation. On the supply side, the actual construction output is estimated by the EBI Construction Activity Report. It looks at the entire Romanian construction market, and the latest edition points to a rush to completion, with multi-unit residential projects seeing an uptick in completion, at the cost of activity starts. For the detailed analysis please write to ebi@ibuild.info.

Conclusion

The Romanian residential market is in a tight spot:

- On the demand side, high prices despite lower wage growth means the affordability of homes went down at the same time as mortgage interest rates shot up. Concurrently, inflation erodes purchasing power by increasing the share of food and necessities in the household budget, leaving less room for mortgages and home renovations.

- On the supply side, increased construction costs, more difficult financing and the global economic uncertainty makes investors skittish.

On the other hand, there are plenty of reasons to be (cautiously) optimistic:

- In February the National Bank of Romania decided against another interest rate hike, citing a slight improvement of the outlook.

- Inflation can also boost real estate investment since homes tend to be a better store of value than other assets in times of high inflation.

- Energy prices somewhat came down with Brent oil, for instance, trading at USD 80-86 in January 2023. This is above its long-term average, but a far cry from the USD 110-120 prices of Q2 2022.

- The Romanian culture values home ownership to an unusual degree, boasting the highest share of home ownership in the EU (96% in 2020, versus the European average of 70%, source: Eurostat). This means that demand for new homes is generally high, regardless of economic conditions.

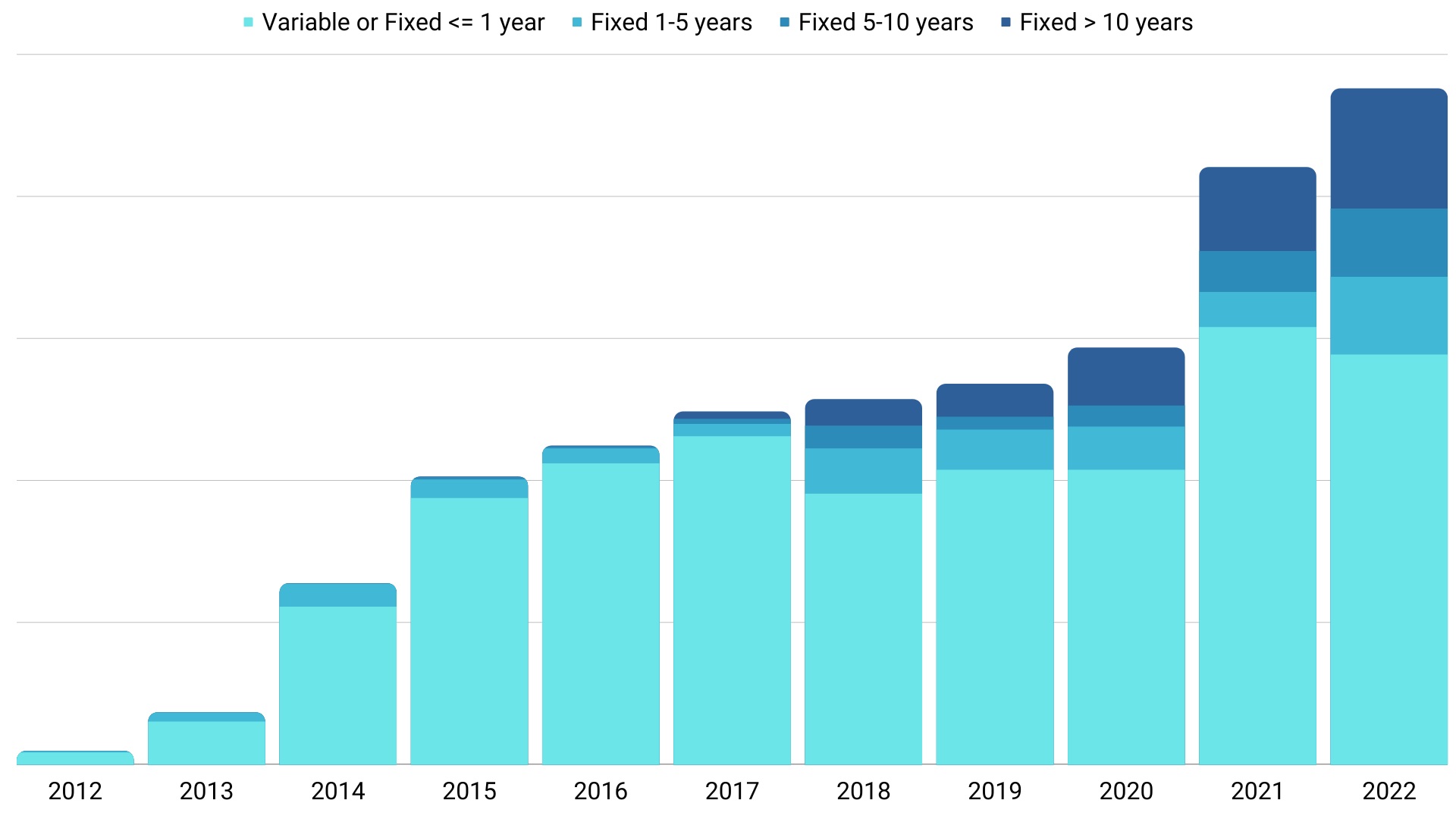

- A significant portion of mortgage loans in the past years were issued in RON with fixed interest terms of 5 years or more, which makes them quite resilient to short term shocks.